Checks as a means of payment: recommendations

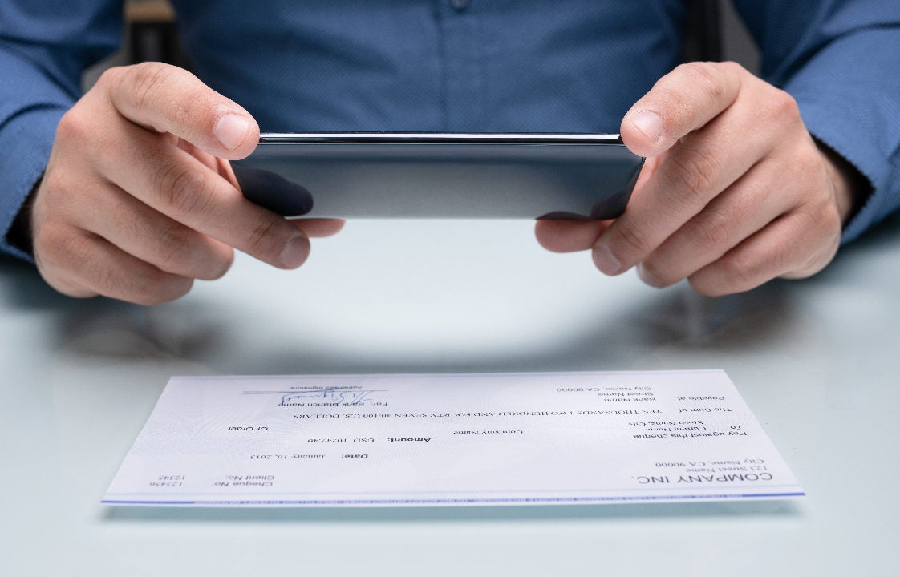

Credit cards and the development of electronic banking have reduced the use of the traditional check to make payments, but it is still a payment system that is used throughout the world. The check is a document that serves as a payment channel between an individual or company, who issues or signs it (called “drawer”), and the “beneficiary” or “holder” (the natural or legal person who can collect it). Thus, the first of them orders the bank to pay an amount of money to the beneficiary of the check.

Types of checks

To the bearer. The name is not specified in the space where the beneficiary is indicated. In case of loss of the check, anyone who finds it can cash it without identifying themselves. You can easily order checks online.

Nominative. It can only be charged by the person who appears as the beneficiary of the same by presenting an official identification documentation. Sometimes the clause “to order” is included, which means that the right of collection by another person is viable, or “not to order”, which would prevent its transmission to a third party.

Crossed. When a check has two parallel straight lines and a diagonal on the face, it indicates that it can only be deposited in the account of a bank and not be cashed in cash but through said account.

Shaped. The bank that has to pay it assures the person who is going to collect it that the person issuing the check has funds and that, therefore, it will be paid.

Topay into account. It cannot be collected in cash, but must be deposited into a bank account.

Traveling. They are issued by banks or savings banks and other recognized financial intermediaries, such as American express, mastercard or visa. They can be exchanged for cash in another country or used as a means of payment.

Banking. The one who signs the check is the same bank that must pay it.

Window. It is a document signed by the client as proof that he has received cash from his own account at the bank teller window.

Tips for operating with checks

Users show a certain distrust of this means of payment. Some consider it high risk and unsafe due to the potential for forgery fraud, theft, bad check or other scams.

To prevent both the issuer of the document and the holder of it from being involved in any type of fraudulent situation, it is essential to follow a series of recommendations:

Never have blank signed checks.

Do not fill it in until the moment you deliver it.

Check that the check book is duly sealed and complete. If there is any anomaly, the bank or savings bank must be notified immediately.

Keep it in a safe place, to avoid that your signature can be forged.

Destroy invalid checks and don’t just throw them away.

Surround the amount with symbols or lines to make it impossible to change the amount. Also write the figure twice, with number and letter.

Have adequate funds for covering the check amount. If not, the bank may charge a surcharge.

For the person who wants to cash the check in cash, it is advisable to present it at the same branch that appears as drafted. This will avoid commissions.